It’s time B2B payments caught up with B2C.

Today, 50% of B2B payments still happen by check–which means there’s a $200 trillion opportunity for digital B2B payments over the next decade.

The future is digital. (The present is, too.)

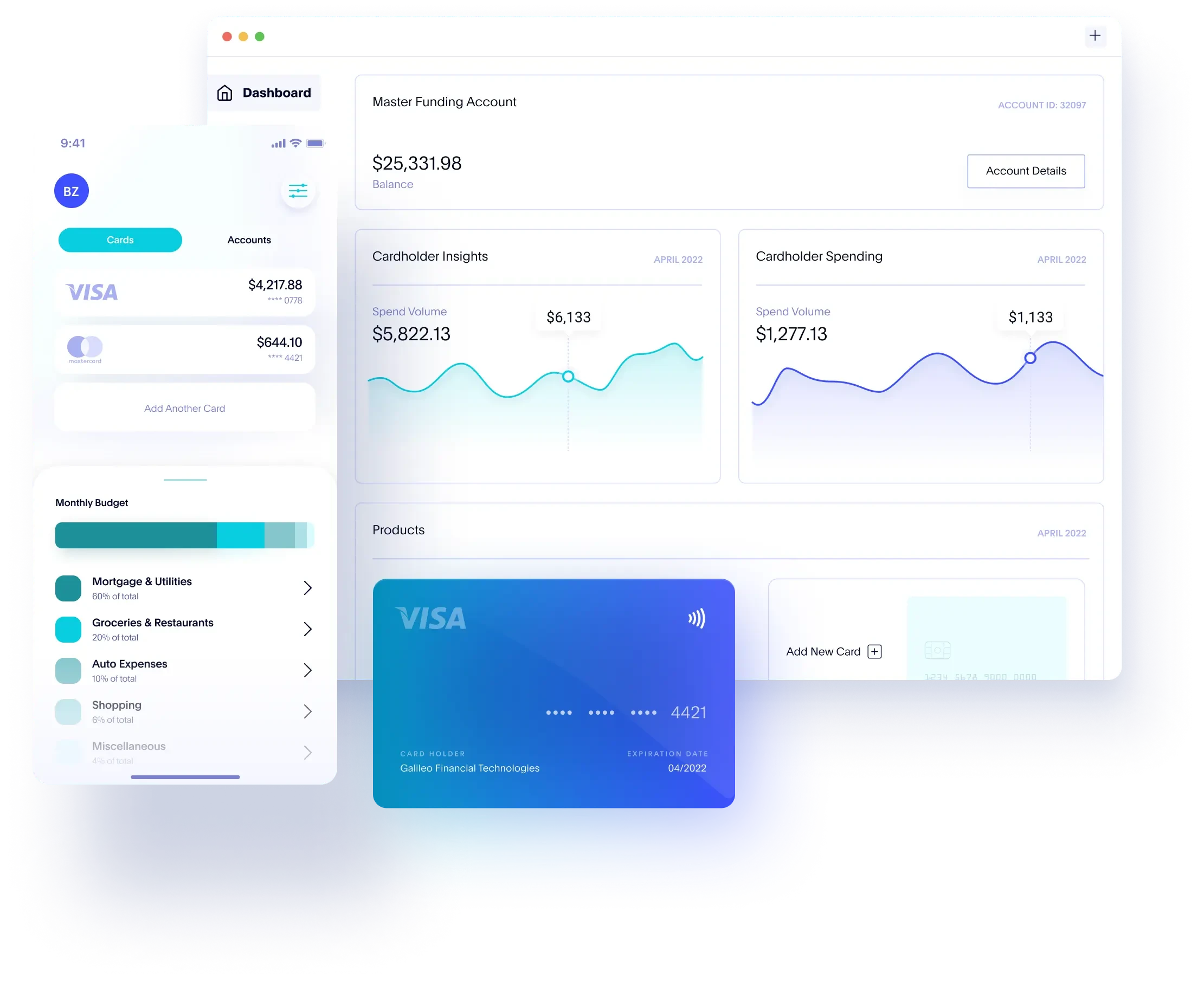

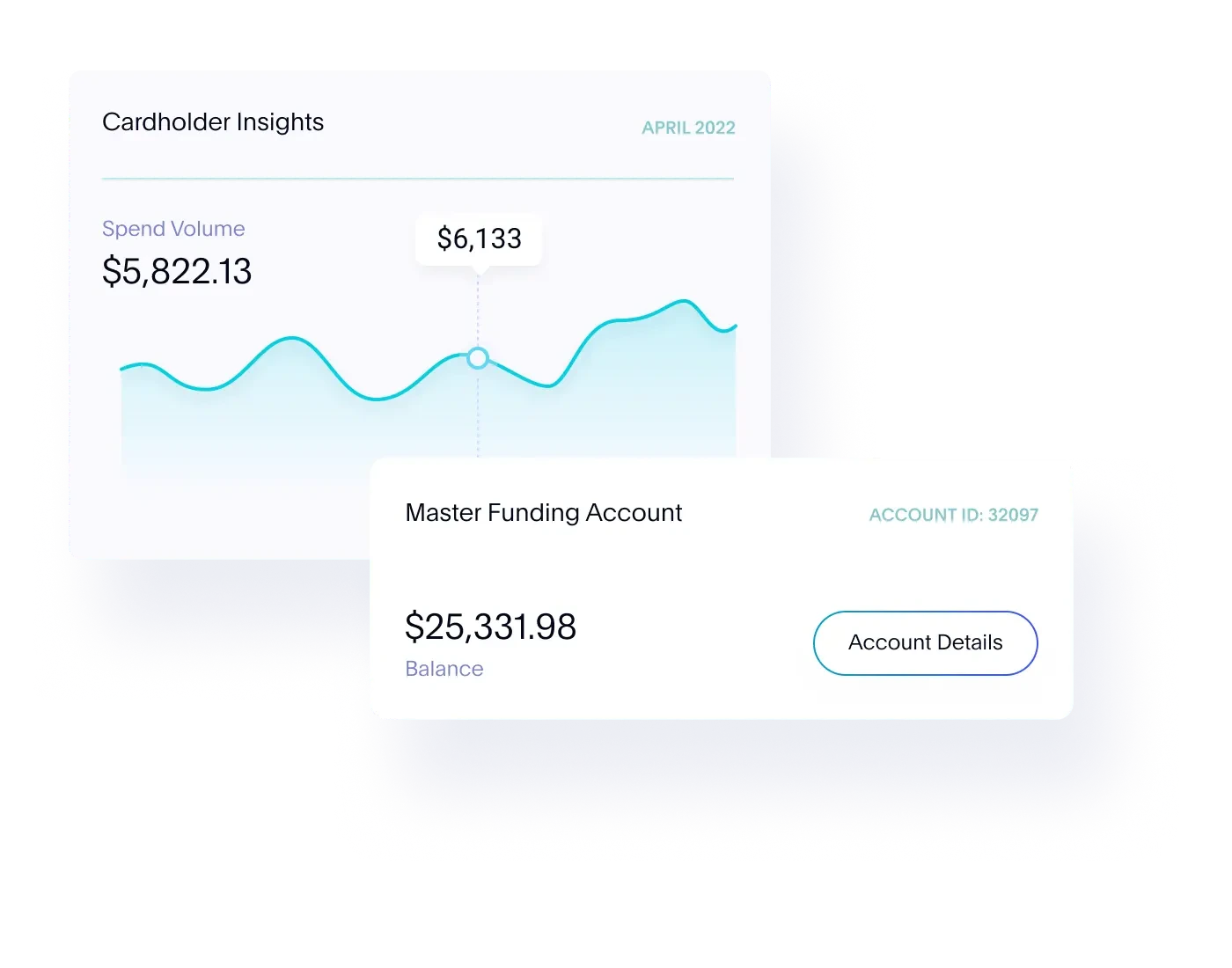

Clarity and control for your business expenses.

One platform, tailored experiences.

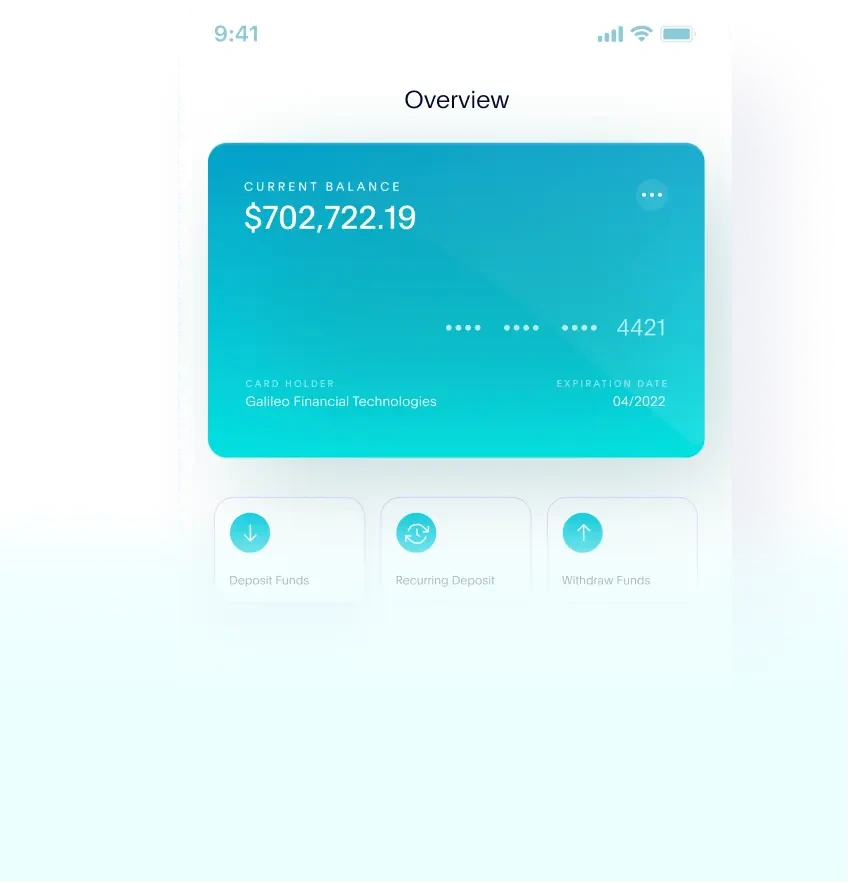

Improve your customer experience with a myriad of deposit options like direct deposit, early pay, round-up and overdraft capabilities.

Seamless and secure transactional experiences are the baseline for payment processing and money transfers today.

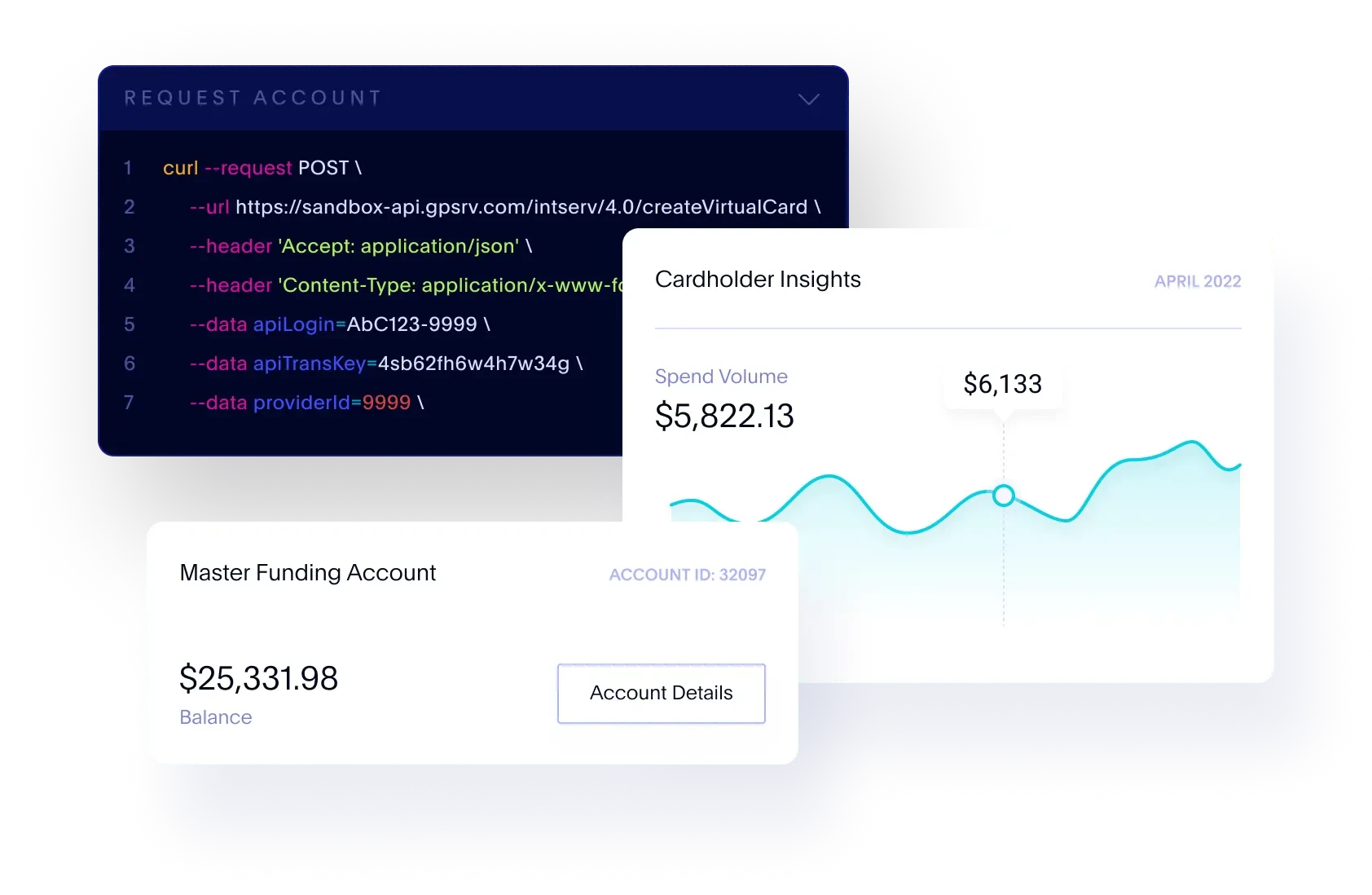

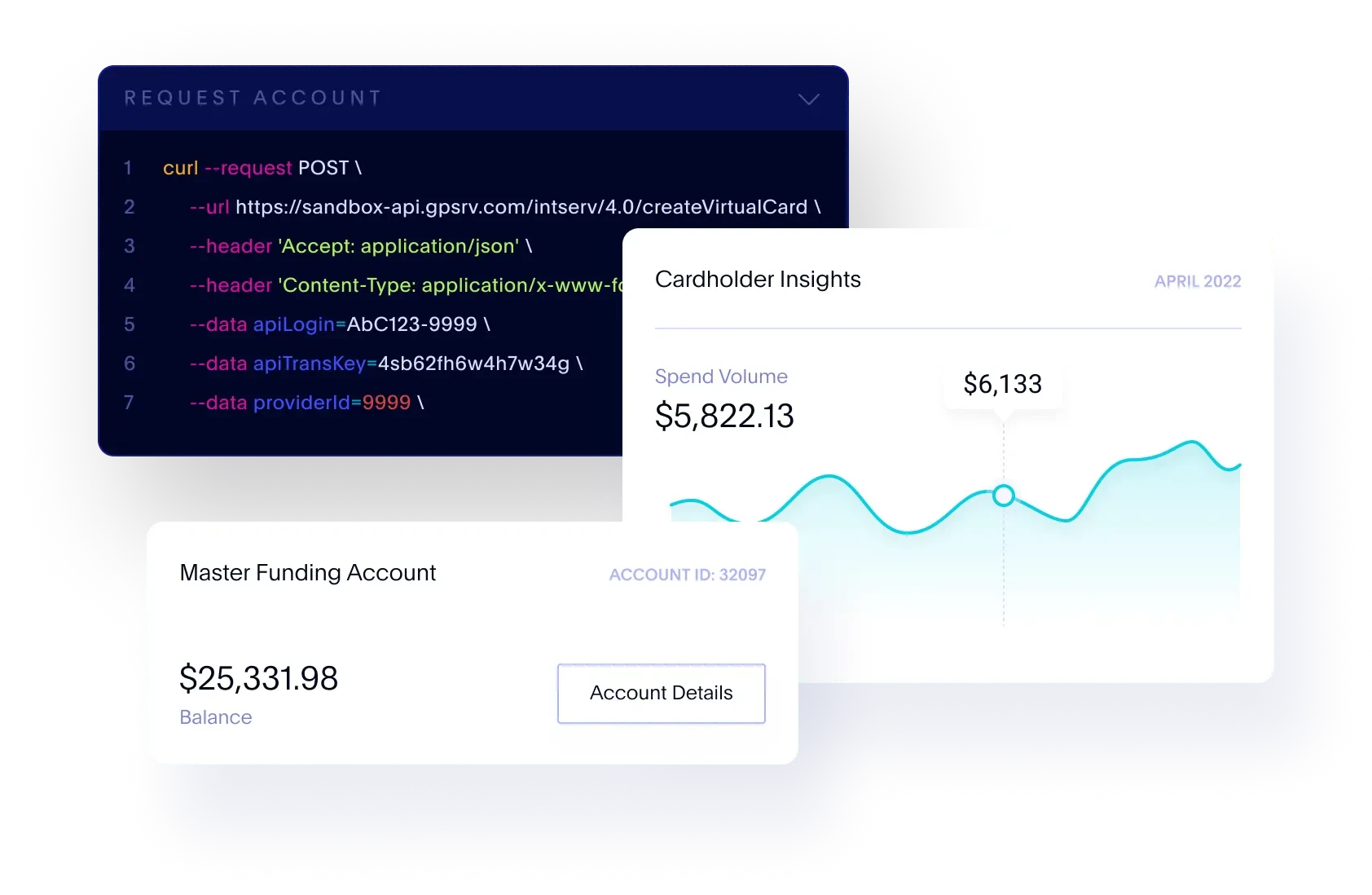

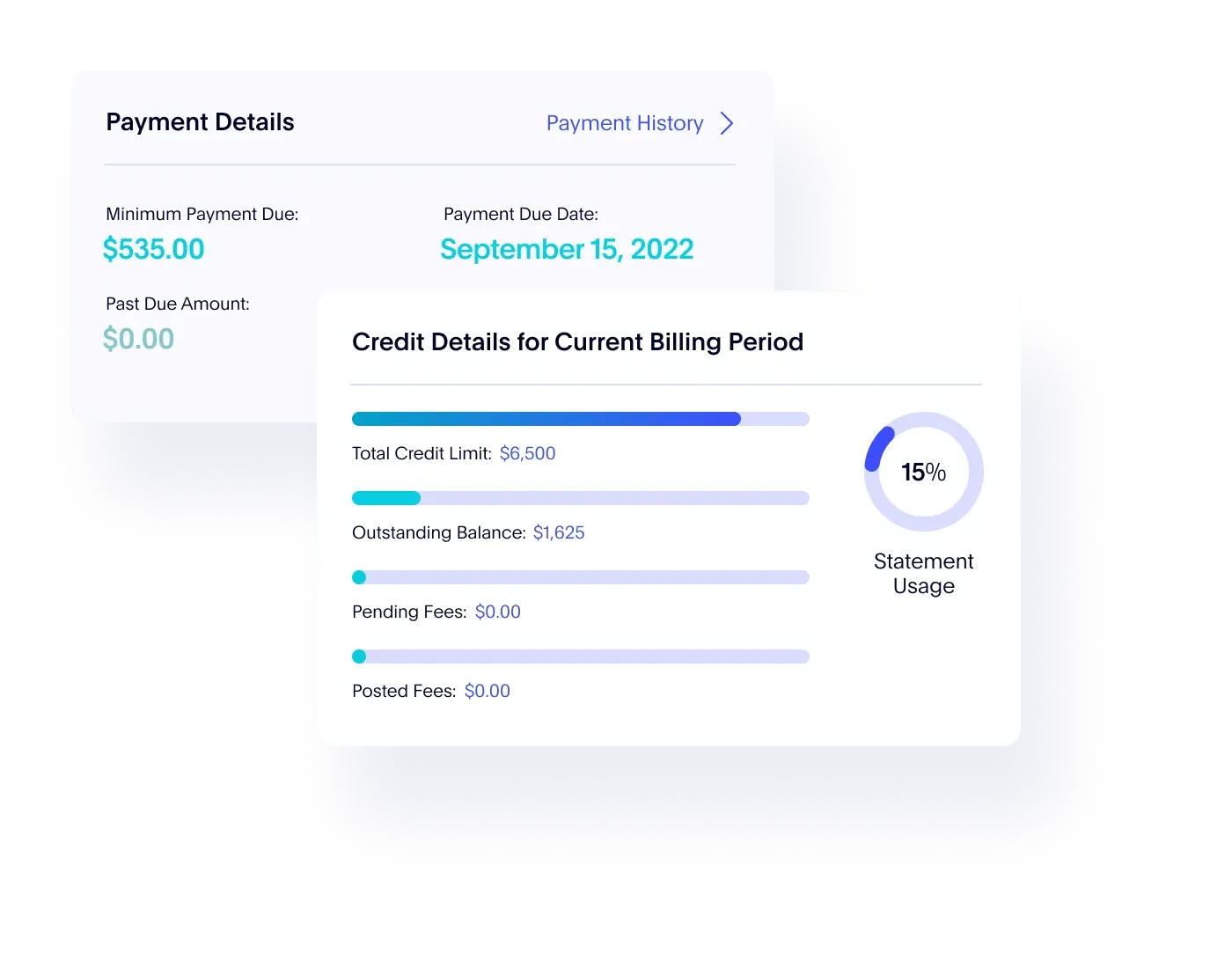

Whether it’s delivering faster, innovative credit solutions—such as single-use virtual credit cards-or lending services such as personal loans, installment loans, or secured credit, Galileo has you covered.

Digital-first experiences for businesses.

MONEY IN

MANAGE MONEY

Your business clients need greater, flexible control over their revenues.

Learn how our solutions can elevate your offerings with a personalized self-guided demo of our APIs.

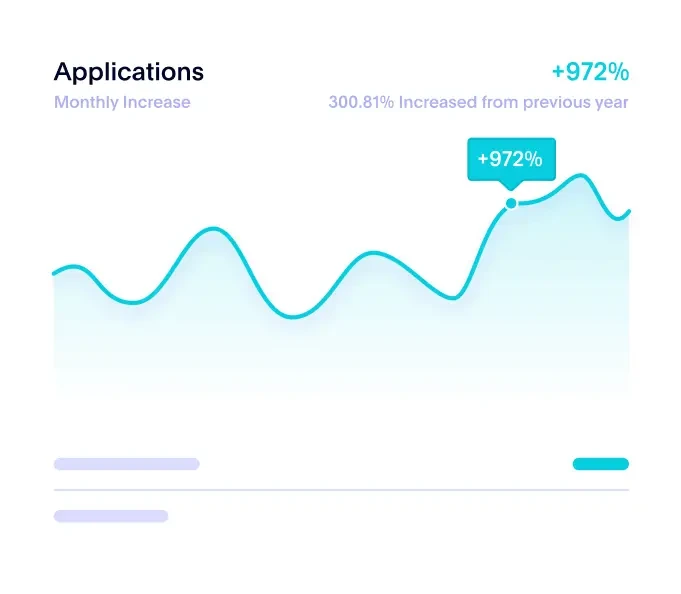

Consumers’ changing preferences are leading to B2B innovation

65%

OFFER DIGITAL B2B METHODS

Portion of companies that offer digital B2B payment methods.

30%

EFFECTIVE PAYMENT SOLUTIONS

Share of businesses that believe their current B2B payment solutions are either “very” or “extremely” effective in solving key friction points.

Get to market fast and scale.