Buy Now, Pay Later (BNPL) is surging in popularity among consumers worldwide, quickly becoming a mainstay payment option for both e-commerce and in-store shopping. In the U.S. alone, the number of BNPL users reached 45 million last year–up 300 percent annually from 2018–who spent a collective $20.8 billion on BNPL transactions.

But while the BNPL market thus far has been dominated by specialty providers whose services are distributed at the point of sale via merchant partnerships, there are significant advantages to a bank-provided buy now, pay later model. And consumers are eager for their banks to enter the arena, with more than 70 percent of BNPL users interested in getting BNPL services from their bank.

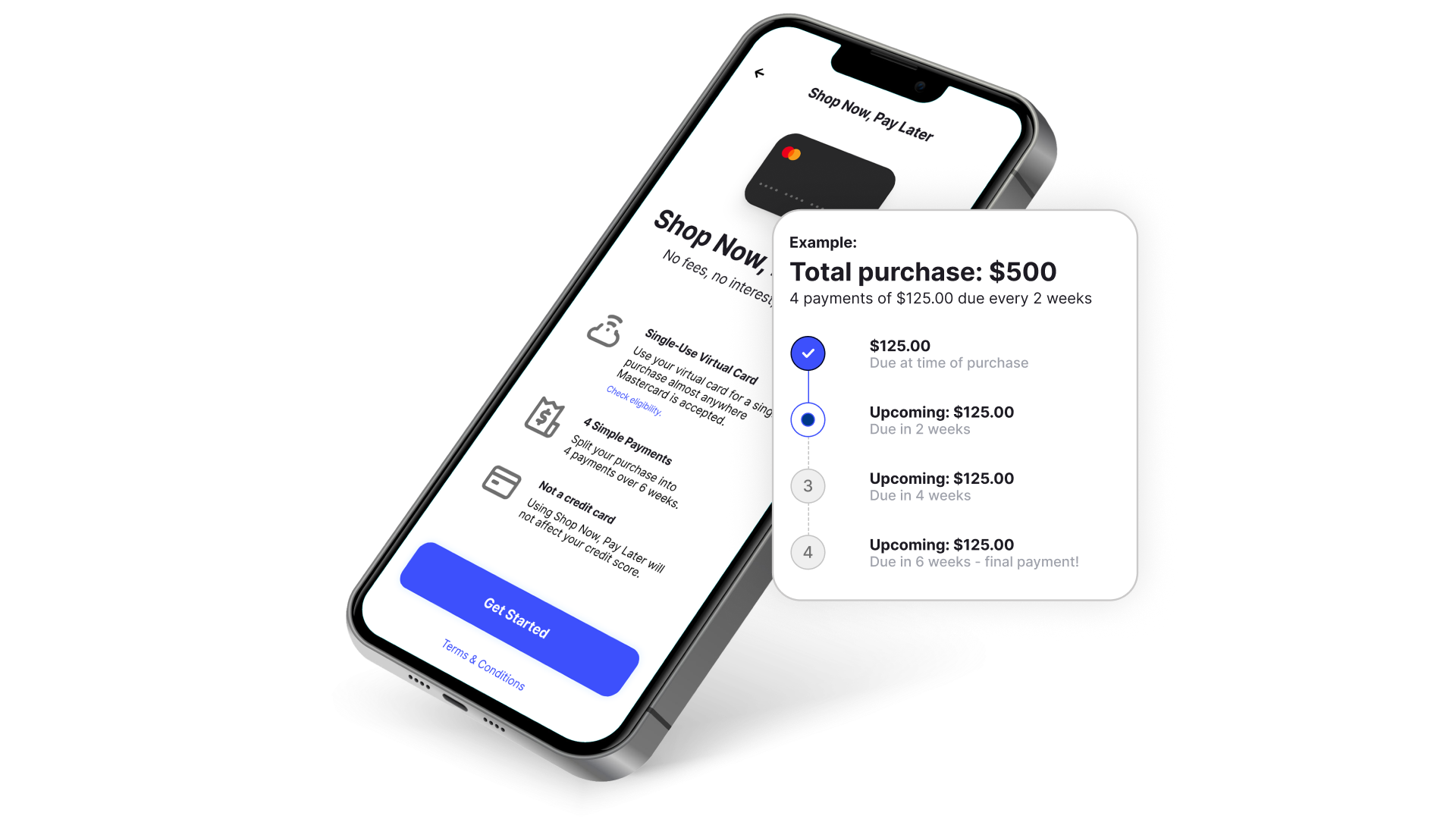

For established financial institutions and challenger banks alike, that demand represents a major opportunity to get in the BNPL boom. And to help providers capture that growth potential, Galileo1 has launched a new Buy Now, Pay Later solution that offers single-use virtual cards and a loan management platform, giving banks and financial services providers easy entry into the red-hot BNPL market–and a prime path to achieving enhanced customer spending volume and interchange revenue.

To learn more about the new Galileo Buy Now, Pay Later offering, register to watch a video presentation by Kevin Toney, senior product manager for Galileo. In it, you’ll learn:

Why Galileo’s new service enables you to offer customers a better BNPL experience with seamless delivery, wider usability and better underwriting

How your bank benefits from enhanced interchange revenue, repayment flexibility and Galileo-provided loan management features

How the BNPL solution can easily be added to existing Galileo services, or act as the perfect starting point for wider collaboration.

Fill out the form to watch the video and get in on the BNPL boom with Galileo.

1Galileo Financial Technologies, LLC is a technology company, not a bank. Galileo partners with many issuing banks to provide banking services in North and South America.