The future of fintech is human-led and AI-enabled.

The numbers to back it up.

1.7K

TEAM MEMBERS

55+

PLATFORM PARTNERS

158M

ACCOUNTS

People

Our people are our greatest asset. They separate us from the competition and can bring your idea to life.

Finance is global. So is Galileo.

We work with leading companies all over the world—like H&R Block, Dave.com, MoneyLion, SoFi and Monzo, to name a few.

Meet our leaders.

Join the team building the future of money.

Frequently asked questions.

Galileo provides the APIs and platform to build, launch, and scale financial products. Whether you’re a bank, fintech, or brand, our technology helps you offer accounts, payments, and card programs that are reliable, scalable, and secure.

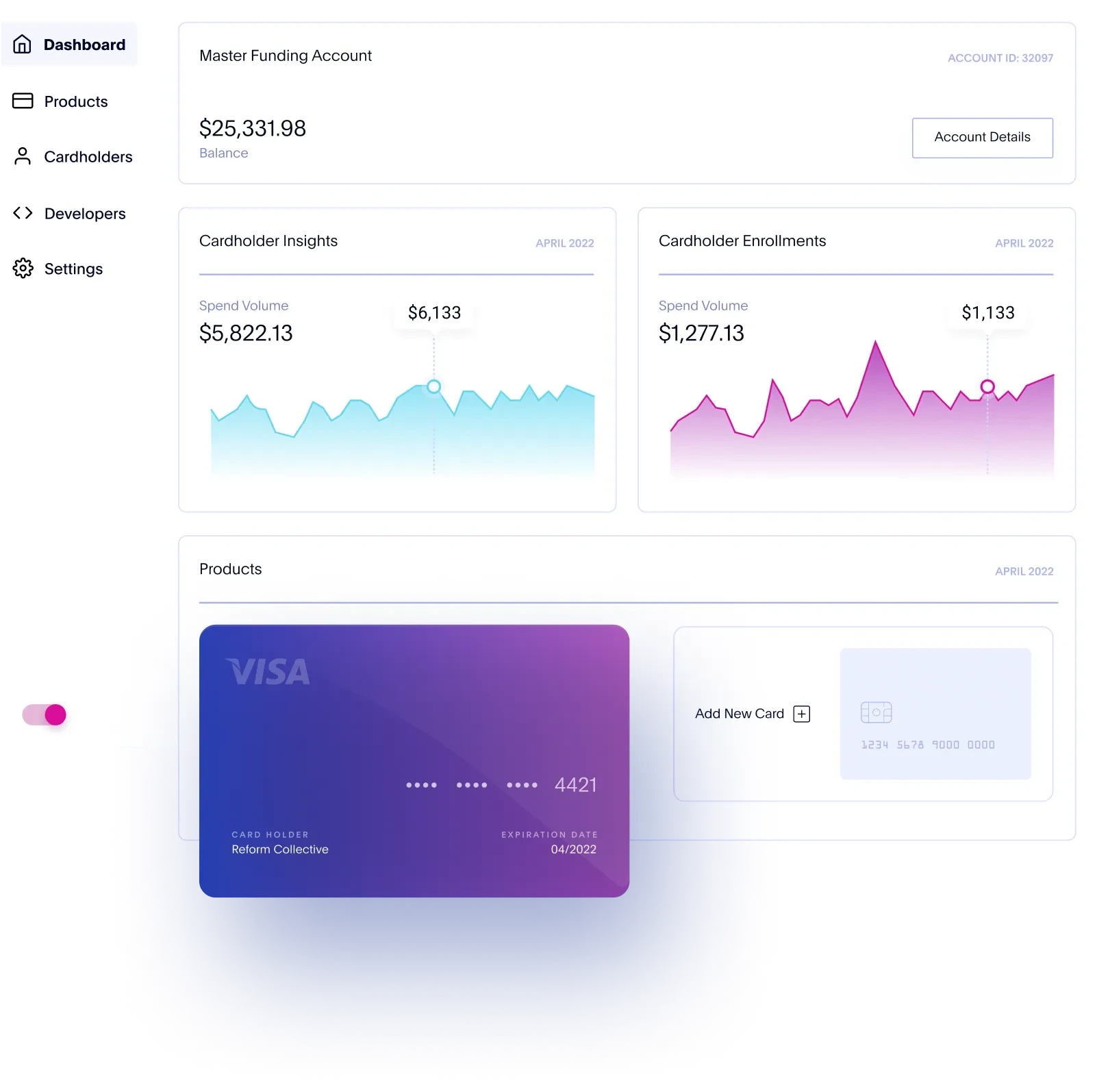

Accounts & Ledgers: Open and manage digital deposit accounts, maintain balances, and track transactions.

Payments & Transfers: Support for ACH, wires, real-time payments, and peer-to-peer transfers.

Card Issuing & Processing: Physical and virtual debit and credit cards, transaction authorization, and settlement.

Fraud & Risk Tools: Built-in monitoring and controls to help reduce fraud and manage risk.

Data & Insights: Access to transaction data and reporting to better understand customer behavior.

Compliance Support: Tools and workflows designed to help you stay aligned with regulatory requirements while retaining control of your compliance strategy.

Bottom line: We provide the backbone so you can focus on designing differentiated customer experiences. With Galileo, you don’t need to reinvent the financial infrastructure—you can plug into ours and bring your products to market faster.

Typical Clients

Banks: Traditional and digital banks that want modern infrastructure to launch new products, expand into new markets, or modernize their existing systems.

Fintechs: Startups and scale-ups building new financial services, from digital wallets to banking apps.

Brands: Non-financial companies embedding payments, accounts, or rewards into their customer experience (e.g., retail, travel, B2B platforms).

Why They Choose Galileo

Global Reach: Support for digital-first financial programs in 14 countries.

Proven Scale: More than 160 million accounts running on the platform, with hundreds of billions in annual payment volume.

Deep Experience: 25 years building and scaling fintech and payments programs.

Infrastructure Built for Growth: A platform designed to support clients from early-stage launch through global scale.

Bottom line: Galileo serves banks, fintechs, and brands that need reliable, scalable infrastructure to power financial products at any stage of growth.

Galileo stands out by offering a unified, extensible platform built for composable banking and fast go-to-market.

Breadth of Bank Relationships: We’re connected to 25+ sponsor banks, giving clients options instead of locking them into a single path. That flexibility matters for scale, compliance alignment, and long-term resilience.

Network Agnostic: Galileo supports every major card network and can integrate with whichever a client chooses. You’re not constrained by our preferences — you control how your program runs.

Platform Agnostic: Unlike closed systems, Galileo can work alongside other providers and integrate into existing ecosystems. If you’re already using fraud tools, KYC providers, or core systems, we plug in instead of replacing them.

Global Scale + Proven Reliability Hundreds of millions of accounts and hundreds of billions in annual payment volume flow through our platform. That scale and uptime have been tested across digital banks, fintechs, and Fortune 500 brands.

Experience That Reduces Risk: More than 20 years launching and scaling fintech programs means we know the regulatory, operational, and technical pitfalls — and we help clients avoid them.

Bottom line: The differentiator isn’t just “modern APIs” (everyone says that). It’s choice + flexibility — Galileo doesn’t force clients into one bank, one network, or one stack.

Broad Connectivity: Our APIs don’t stop at one sponsor bank or network. You can connect to 25+ issuing banks, all major card networks, mobile wallets, processors, and card manufacturers through a single integration.

Agnostic by Design: Already have fraud tools, KYC, or a core? No problem. Galileo APIs are built to integrate with what you bring to the table instead of forcing a rip-and-replace.

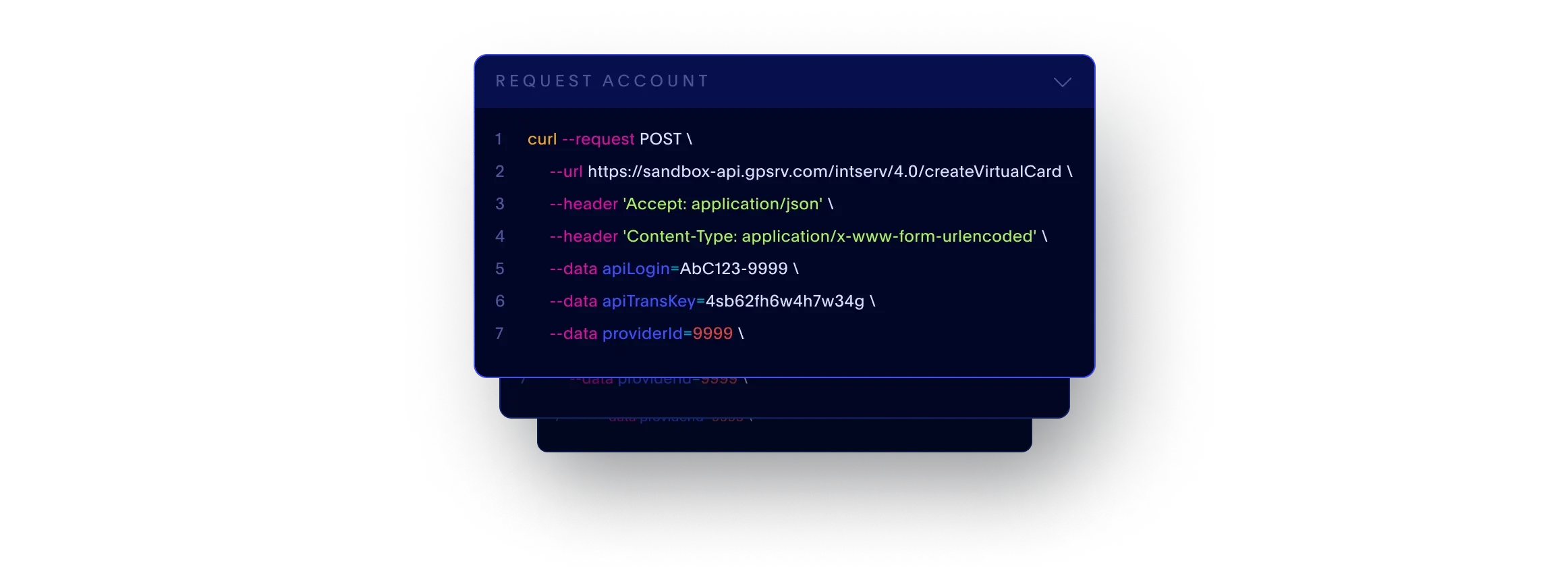

Developer Experience: RESTful APIs, clear documentation, sample code, and a sandbox environment with realistic test data. Developers can spin up and start building within minutes via the dashboard.

Unified, Composable Layer: Accounts, payments, card issuing, and risk tools are all accessed through the same API framework — so you don’t need to stitch together multiple providers or manage conflicting integrations.

Bottom line: Galileo gives you more options, flexibility, and speed than competitors. You can build with the banks, networks, and tools you choose — without fighting integration barriers.

Galileo protects every transaction with advanced fraud analytics, real-time verification, and strict compliance standards.

Real-Time Account & Ownership Verification (GIVE): Galileo Instant Verification Engine (GIVE) lets you check if an external bank account exists, whether it’s active, and if the ownership matches the user in seconds — not days. This reduces failed ACH transfers, NSF (non-sufficient funds) issues, and fraud attempts during account linking.

Dynamic Risk Scoring (GScore + Payment Risk Platform): Every transaction — card swipes, ACH, or money movement — is scored in real time using machine learning, behavioral data, and account history. You set the thresholds and rules for when to allow, challenge, or block a transaction.

Configurable Fraud Decisioning (Payment Risk Platform): Galileo’s Payment Risk Platform gives you a configurable rules engine, a knowledge graph to identify fraud rings, case management tools, and the ability to back-test policies before deploying them.

Compliance: PCI-DSS certified, cloud-native, regulation-ready with AOC documentation.

Bottom line: Galileo doesn’t just run fraud checks — it gives you verification, scoring, and decisioning tools you control, so you can strike the right balance between stopping fraud and keeping customer experiences smooth.

Yes — Galileo enables secure, multi-currency transactions across 14 countries in North and Latin America.

Global Reach: Operations in 14 countries with expanding coverage.

Multi-Currency Support: FX handling, cross-border settlement, and card network integrations.

Certifications: Mastercard certified outside the U.S.; Visa certified in Canada and Mexico.

International Features: Currency conversion, foreign ATM support, and 3-D Secure authentication.

Result: Galileo empowers clients to scale programs globally without adding technical complexity.

Galileo currently supports 14 countries across North and Latin America.

Argentina

Brazil

Canada

Chile

Colombia

Costa Rica

Curaçao

Ecuador

Honduras

Mexico

Panama

El Salvador

United States

Uruguay

Bottom line: Galileo empowers clients to scale programs globally without adding technical complexity.

Yes, we’ve launched and scaled some of the largest payment and banking programs in the world.

Trusted by Leaders: Powers financial products for some of the largest banks, fintechs, and consumer brands in the U.S. and Latin America.

Accounts at Scale: Supports more than 160 million accounts across the region.

Transaction Volume: Processes billions of transactions each year, with growth accelerating.

Enterprise Ready: 1,700+ employees delivering secure, scalable infrastructure for established institutions and fast-growing innovators.

Built to Grow: Cloud-native platform that scales with client demand, supporting higher volumes and new market expansion.

Bottom line: From leading banks to global brands, Galileo provides the infrastructure to launch, scale, and modernize financial products across the Americas.

Galileo offers flexible pricing with models tailored to business needs.

Transaction-Based: Per-use fees covering authorizations, settlements, and declines.

License & Maintenance: Optional fixed arrangements for platform use.

Add-On Tech: AI-powered digital assistants, real-time risk engines, and other modules.

Bottom line: Clients can choose a cost model that matches their growth stage and product strategy. Something we will work with you closely to create.

Galileo provides a request-only developer sandbox and scheduled demos; we do not offer a public “free trial.”

Request access to the Sandbox to explore API capabilities.

Developer docs & quickstart guide integration once sandbox credentials are issued.

Production-like testing in the sandbox speeds prototyping before contracting.

Bottom line: Teams can validate integrations and launch prototypes before going live.

Galileo supports its clients through a combination of dedicated resources and specialized technical channels:

Relationship Managers: Clients are supported through dedicated relationship managers.

Developer Support: Technical assistance is available for developers through:

Technical Portals and Documentation: Access to resources for quick resolution of technical or integration questions.

Galileo Technical Advocates: Technical assistance is provided to clients for help with subject matter expertise, prescriptive intelligence, and third-party integration.

Galileo Support Helpdesk: Clients can contact the Galileo Support helpdesk or open an online support ticket for general technical assistance.

Live Assistance (Phone): Direct access to a Galileo advocate is available during business hours for technical assistance.

Galileo offers a flexible, outsourced, and technology-driven customer service solution that its clients can leverage for their end-users. This support is designed to ensure clients' customers receive assistance when and how they need it, in line with modern digital banking expectations:

Self-Service (Conversational AI): Galileo offers 24/7 intelligent digital assistants (such as "Cyberbank Konecta")—a conversational AI engine designed to handle the majority of routine inquiries for banks, fintechs, and digital banking users.

Live Human Assistance:

If the AI assistant cannot fully resolve the issue, users have options for text, phone, or video escalation to live agents.

Clients have flexibility to use onshore or offshore call centers, with options for in-house or third-party providers.

Customer service agents are trained on the client's products to handle inquiries, including transaction disputes.

In-App and FAQ Help: Galileo's solutions often include integrated FAQ sections and guided support workflows to help end-users solve common issues directly within the application.

Turnkey Outsourced Service: Galileo provides a turnkey outsourced customer service administrative portal and Interactive Voice Response (IVR) tools, allowing clients to implement comprehensive customer service without building the entire system in-house. This includes:

Standard IVR functionality (e.g., lost/stolen card reporting, balance inquiries).

Data-driven messaging and decisioning.

Detailed KPI reports for clients to monitor customer issues.

Galileo’s onboarding combines compliance checks, sandbox testing, and hands-on support to ensure smooth launch.

Discovery: A meeting with the sales team to assess if Galileo is a good fit for your program.

Design: A collaborative meeting with the Business Solution Architect team to design the program, including sandbox testing and creating a blueprint.

Agreements: Finalizing agreements and pricing with all parties—Galileo, the sponsor bank, and any third parties—and receiving regulatory approvals.

Build: Working with a technical project management team to build out the program based on an agreed-upon timeline and technical specifications.

Launch: Going to market after all steps are complete, with some programs launching in as little as three months.

Bottom line: We pride ourselves on launching programs fast and will work with you and your team on an agreed timeline.

Galileo offers flexible contract structures, including direct banking relationships and full Banking-as-a-Service (BaaS).

Direct Model: Client contracts directly with sponsor bank; Galileo serves as processor.

BaaS Model: Galileo acts as program manager and processor.

Terms: Confidentiality, indemnification, and service-level agreements (SLAs) built into contracts.

Bottom line: Clients choose a model that balances control, compliance, and operational support.

Galileo provides customer support, dispute resolution, and technical guidance throughout every stage of growth.

Coverage: Technical integration, compliance, and operational assistance.

Channels: Self-service tools, text, phone, and video handoffs.

Partnership: Solutions team works alongside clients as programs scale.

Bottom line: Clients receive comprehensive support from launch to enterprise expansion.

Galileo’s developer portal (docs.galileo-ft.com) offers complete API documentation and integration tools.

Sandbox Resources: 250+ API methods with sample requests and responses.

Human Support: Our team is available to answer any questions you may have.

Developer Aids: Auto-generated code fragments for multiple programming languages.

Bottom line: Teams can quickly prototype and build solutions with production-ready API documentation.

Galileo’s cloud-native platform deploys updates without disrupting customer flows or transaction processing.

Architecture: Built on AWS for scale, security, and reliability.

Continuity: Real-time transaction notifications and proactive status updates.

Resilience: Redundant systems keep services available during upgrades.

Bottom line: Clients benefit from continuous improvements with minimal operational risk.

Galileo accelerates adoption with developer education, sandbox learning, and ongoing training content.

Developer Tools: Sandbox environments and extensive documentation.

Learning Content: Webinars, tutorials, and educational updates via LinkedIn and email.

Code Support: Examples generated for popular programming languages.

Bottom line: Clients ramp faster with a mix of hands-on resources and expert training.

Galileo protects digital banking platforms with multi-layered security and strict compliance standards.

Real-Time Verification: Galileo Instant Verification Engine (GIVE) reduces verification times from days to seconds.

Fraud Detection: Machine learning analyzes 550+ attributes; rules-based engine prevents fraud before it occurs.

Validation Processes: Rigorous checks ensure transaction and fund transfer integrity.

Compliance: PCI-DSS certified, with sensitive data masked by default and a regulation-ready cloud-native platform.

Bottom line: Fraud losses reduced to less than 1 basis point, outperforming industry benchmarks.

Galileo integrates seamlessly with banks, payment networks, and digital wallets through flexible APIs.

Third-Party Connectivity: 20+ issuing banks, specialty providers, and card manufacturers.

Digital Wallets: Supports Apple Pay, Google Pay, and Samsung Pay.

Unified Platform: Single API integrates core banking, card issuing, and payments.

Fintech Ecosystem: Galileo has built out one of the most integrated fintech ecosystems with integrations with over 100 fintech partners.

Bottom line: Clients connect to the full payments ecosystem with or without multi-vendor integration.

Galileo secures data through encryption, compliance, and advanced fraud detection.

Compliance: PCI-DSS standards with encrypted data transmission.

Fraud Detection: Machine learning that analyzes transaction patterns.

Audits: Regular penetration testing and security reviews.

Authentication: Multi-factor and role-based access controls.

Bottom line: Sensitive data remains protected across every interaction.

Galileo charges transaction-based fees with additional costs for usage and value-added services.

Transaction Fees: Authorizations, settlements, and declines.

Platform Usage: Volume-based monthly charges.

Value-Added Tools and Support: Fraud management, customer service and compliance services.

Custom Work: Integration and development support fees.

Bottom line: Costs scale with transaction volume and optional service layers.

Galileo’s cloud-native platform scales to handle spikes in demand without service disruption.

Architecture: Built on AWS for scale and resilience.

Auto-Scaling: Expands capacity automatically during surges.

Redundancy: Failover systems ensure continuous uptime.

Growth Ready: Designed to scale alongside customer demand.

Bottom line: Clients maintain reliable service even during peak traffic.

APIs and pre-built connectors make Galileo compatible with third-party financial services.

Open Ecosystem: Connectivity to the broader payments network.

RESTful APIs: Support for popular programming languages.

Testing: Sandbox environments for safe integrations.

Connectors: Ready integrations with major financial services.

Bottom line: Clients embed financial tools quickly and seamlessly.