DEPÓSITOS

Mejore la experiencia de sus clientes con un conjunto completo de opciones de depósito.

Desde el depósito directo hasta el ahorro por redondeo, los consumidores y las empresas esperan una gestión del dinero segura, flexible y sin fricciones. Ya sea un banco ampliando depósitos o una fintech mejorando herramientas financieras, Galileo proporciona la infraestructura para optimizar depósitos y fortalecer relaciones.

La cantidad de cuentas en la plataforma Galileo—y creciendo.

Los clientes esperan más. Ofrezca más.

Una nueva investigación del Informe de Banca de Consumo de Galileo revela que casi la mitad de las nuevas cuentas corrientes en EE.UU. se abrieron en bancos digitales y fintechs el año pasado. Los consumidores están creando sus propios ecosistemas financieros, manteniendo fondos en varias cuentas para maximizar rendimientos, mejorar la conveniencia y acceder a mejores experiencias digitales.

Los bancos y fintechs que no evolucionan corren el riesgo de perder depósitos—no solo frente a los competidores digitales, sino también frente a sus propios clientes que buscan mejores opciones en otros lugares. Para seguir siendo su principal proveedor financiero, debe ofrecer los productos adecuados en el momento adecuado.

Los bancos y fintechs que no evolucionan corren el riesgo de perder depósitos—no solo frente a los competidores digitales, sino también frente a sus propios clientes que buscan mejores opciones en otros lugares. Para seguir siendo su principal proveedor financiero, debe ofrecer los productos adecuados en el momento adecuado.

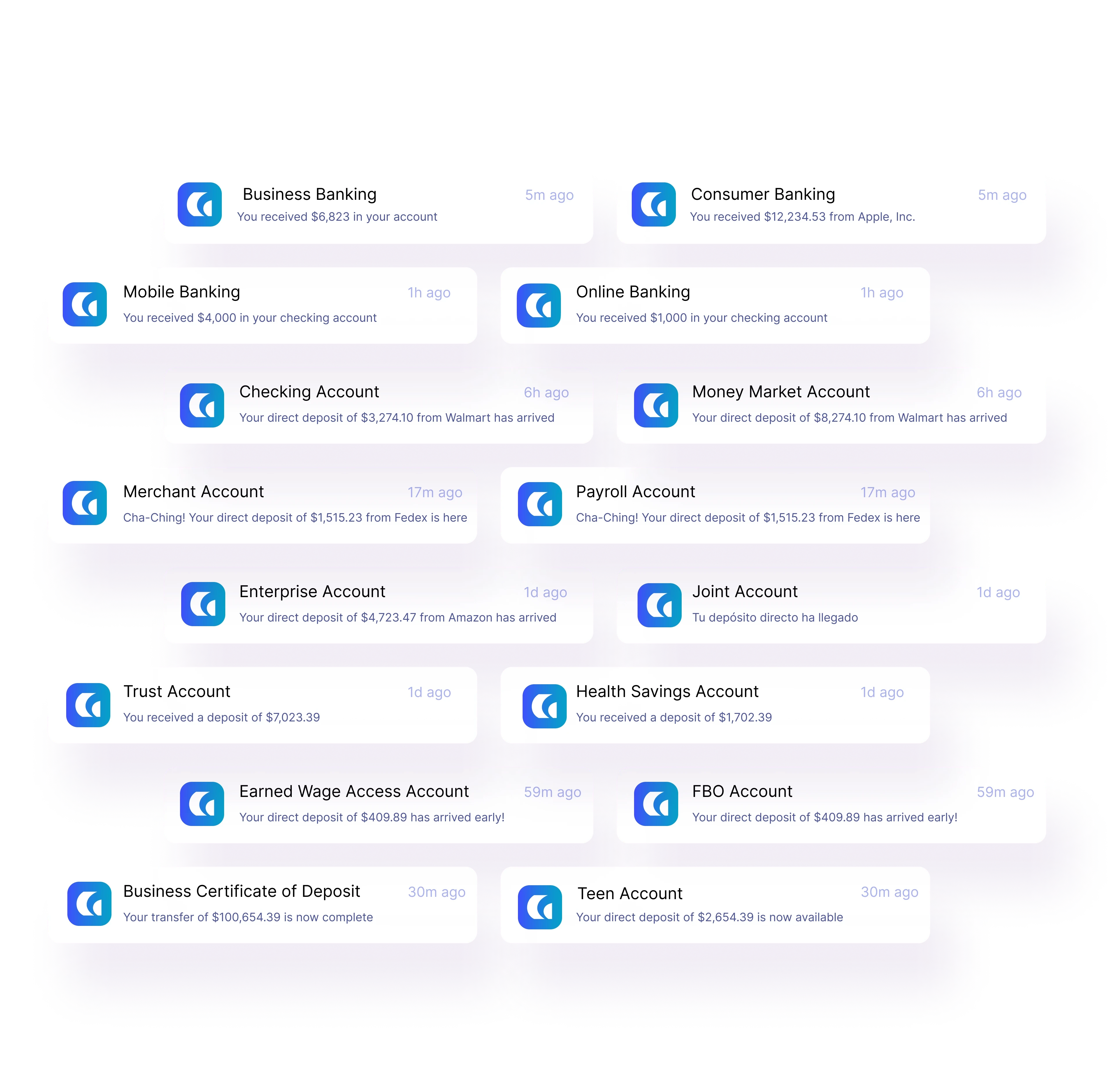

Depósito Directo

Aumente la rentabilidad con el depósito directo.

Los cheques en papel son lentos, incómodos e inseguros. Los clientes no quieren esperar a que se compensen los cheques—esperan acceso instantáneo a sus ganancias. Con capacidades de depósito directo para consumidores y empresas, Galileo permite transferencias rápidas, seguras y sin fricciones a través de ACH, acceso anticipado al salario y depósitos móviles.

Haga que la incorporación sea fluida y aumente la retención con el cambio de depósito directo, que permite a los clientes configurar depósitos sin intervención de RR.HH. ni papeleo—eliminando barreras y acelerando la adopción.

Haga que la incorporación sea fluida y aumente la retención con el cambio de depósito directo, que permite a los clientes configurar depósitos sin intervención de RR.HH. ni papeleo—eliminando barreras y acelerando la adopción.

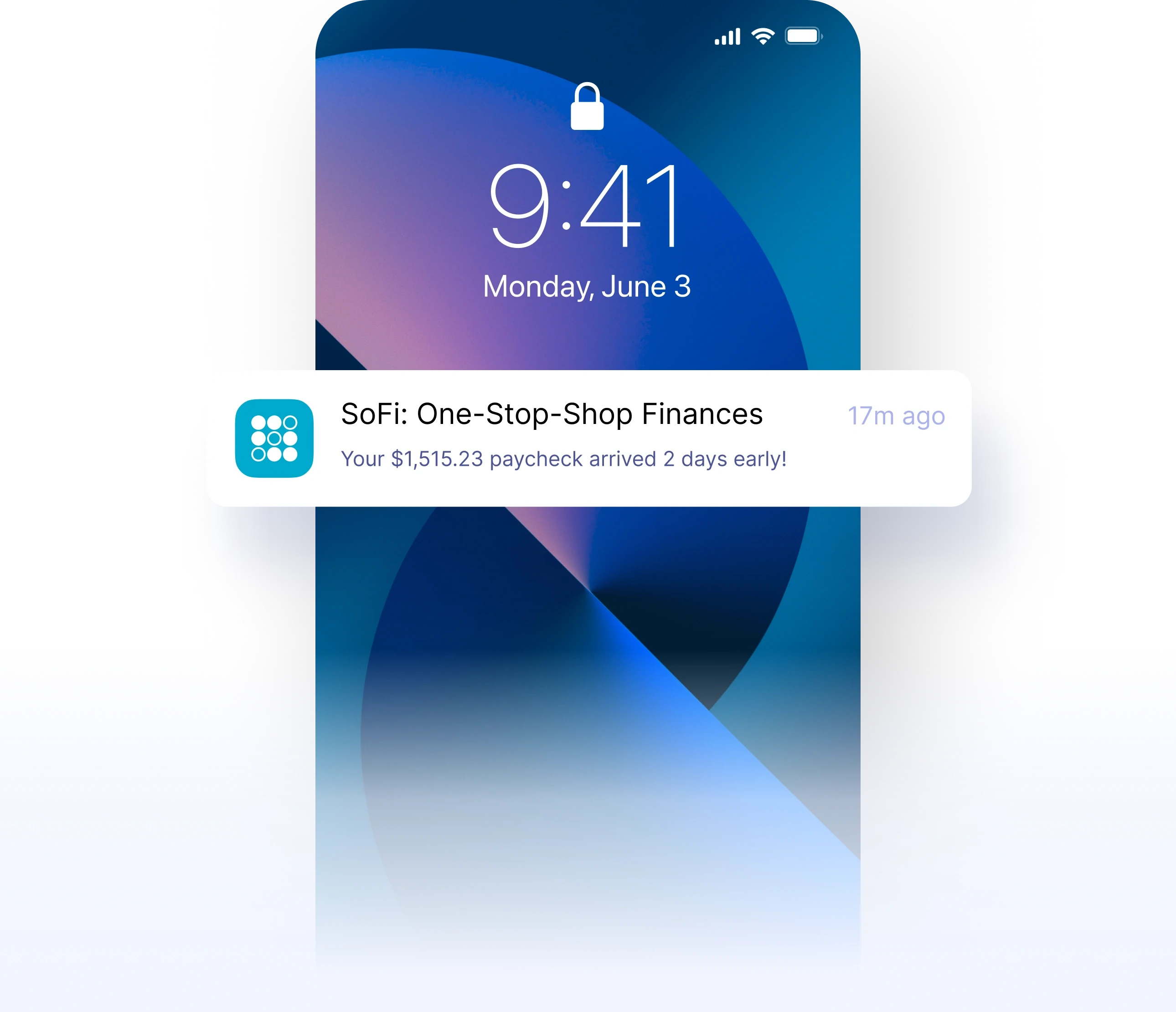

Pago Anticipado

Ayude a los clientes a acceder a su salario antes.

Muchos consumidores viven al día—esperar a que se compensen los fondos no debería ser otra fuente de estrés financiero. Pago Anticipado permite a los clientes acceder a sus ganancias tan pronto como su empleador deposite los fondos—con frecuencia, días antes del día de pago.

Esta función fortalece las relaciones de depósito, aumenta el compromiso y mejora la estabilidad financiera de los clientes—posicionando a su institución como un socio financiero de confianza.

Esta función fortalece las relaciones de depósito, aumenta el compromiso y mejora la estabilidad financiera de los clientes—posicionando a su institución como un socio financiero de confianza.

Ahorro por Redondeo

Ayude a sus clientes a ahorrar sin esfuerzo.

Pequeños ahorros suman. Con las funciones de redondeo, los clientes pueden ahorrar o invertir automáticamente su cambio sobrante—haciendo que la gestión del dinero sea simple y gratificante.

- Las compras se redondean al dólar más cercano.

- Los centavos adicionales se transfieren a una cuenta de ahorros, inversión o caridad.

- Configúrelo y olvídese—construyendo mejores hábitos de ahorro sin esfuerzo.

- Las compras se redondean al dólar más cercano.

- Los centavos adicionales se transfieren a una cuenta de ahorros, inversión o caridad.

- Configúrelo y olvídese—construyendo mejores hábitos de ahorro sin esfuerzo.

Round up savings $0.13

Protección contra Sobregiros

Evite transacciones rechazadas y proteja a sus clientes.

Brinde tranquilidad a los clientes con protección contra sobregiros que garantiza que las transacciones se realicen incluso cuando los fondos son temporalmente bajos.

La solución de sobregiro de Galileo es completamente configurable, permitiéndole:

- Establecer estructuras de tarifas flexibles

- Ofrecer períodos de gracia para mantener a los clientes al día

- Personalizar los límites de sobregiro según el historial de la cuenta

La solución de sobregiro de Galileo es completamente configurable, permitiéndole:

- Establecer estructuras de tarifas flexibles

- Ofrecer períodos de gracia para mantener a los clientes al día

- Personalizar los límites de sobregiro según el historial de la cuenta

Gestión de efectivo

Maximice el valor y la liquidez del titular de la cuenta.

Para bancos e instituciones financieras, las cuentas "sweep" (con depositos automaticos) optimizan los saldos de efectivo al distribuir automáticamente el exceso de fondos entre múltiples cuentas, maximizando el rendimiento y manteniendo la liquidez.

Galileo se asocia con InfraFi para habilitar "Deposit sweep", ayudando a las instituciones a optimizar la gestión de tesorería y los depósitos de los clientes.

Galileo se asocia con InfraFi para habilitar "Deposit sweep", ayudando a las instituciones a optimizar la gestión de tesorería y los depósitos de los clientes.

global/CTA3D.webmglobal/CTA3D.mp4

Loading...